Investment Analysis: IRR Comparison Tool (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BUSINESS CASE DEVELOPMENT EXCEL DESCRIPTION

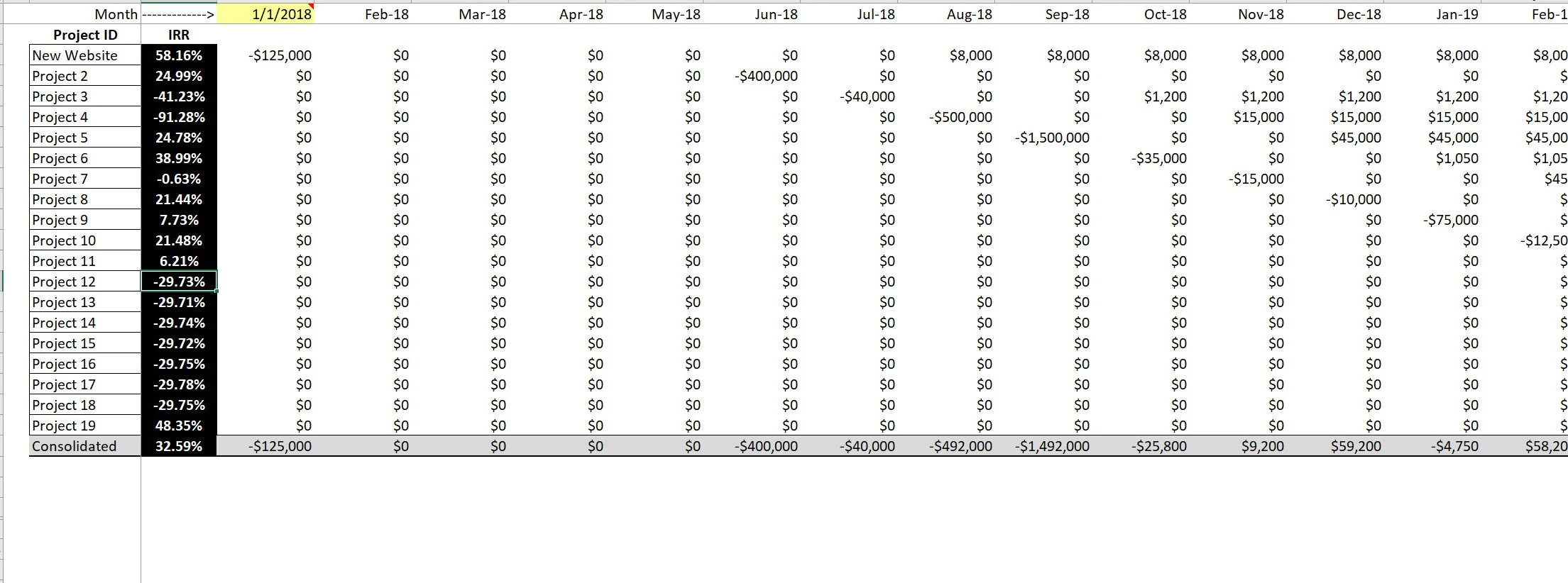

Tracking IRR by way of using the 'XIRR' function in Excel can be tricky when you are looking at multiple cash flow streams with different start dates. You can't just drag the formula down, it needs to dynamically reference the date and cash flow when those cash flows start (the column they begin in) and as you change start dates, the XIRR formulas needs to also change. This template has the indirect function logic to handle such an analysis.

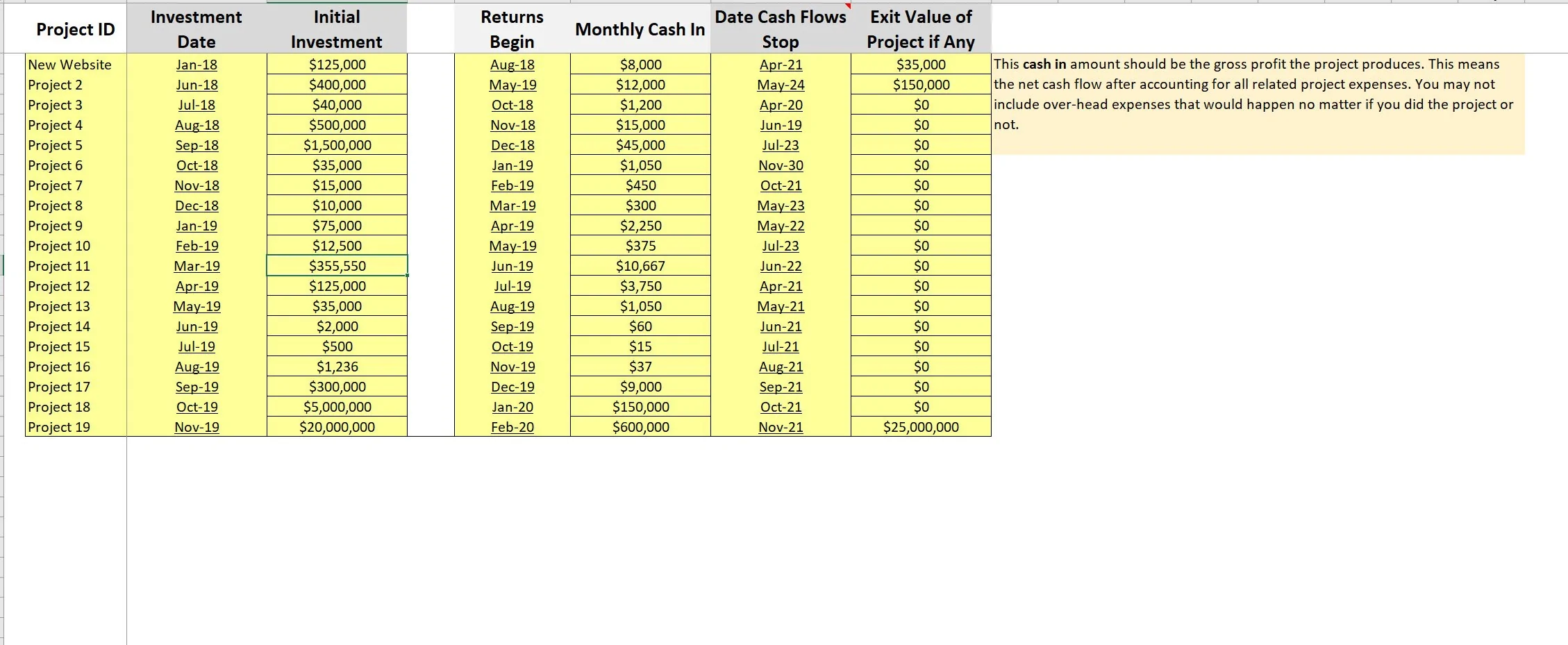

This model is designed to compare various projects that you plan on doing within a given company or separate projects. The point is to compare up to 19 different cash flow streams based on their monthly cash inflows and outflows for up to a 20 year period.

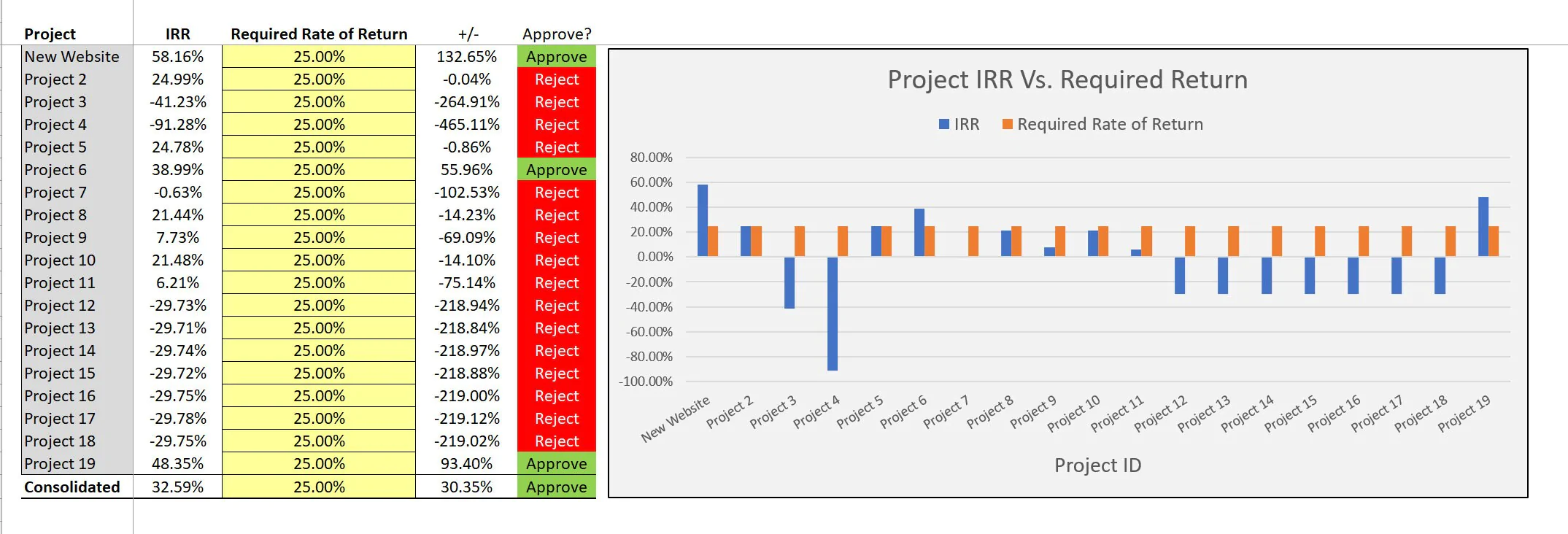

There is a dashboard that displays the IRR of each project (XIRR was used and in order to not get errors, the indirect formula was utilized so each cash flow stream could be properly calculated no matter when the cash started / stopped on the same timeline.

On the dashboard, the user can input the required rate of return and if the IRR is higher than that, it will turn green, otherwise red. A visual displays the results as well. The user can configure cash flows based on a start / stop month, the initial investment, monthly cash flows, exit value.

If these data structures don't fit exactly with your cash flows, simply go to the ‘monthly cash flow' tab and hard code in your expected cash inflows and outflows manually. The calculations will still run off of that.

The purpose of the ability to configure this instead of hard code in each stream is for quicker analysis of many projects.

Finally, if these are all independent projects, the final XIRR calculation will display the consolidated IRR for all projects on the same timeline.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Business Case Development Excel: Investment Analysis: IRR Comparison Tool Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

General Valuation

This bundle contains 10 total documents. See all the documents to the right.